Here’s The One Thing You Need To Know From Wells Fargo’s 110-Page Scandal Autopsy

Running the gauntlet with Wells Fargo.

Running the gauntlet with Wells Fargo.

At least Wells Fargo is consistent.

Protégé™ General AI is fundamentally changing how legal professionals use AI in their everyday practice.

The Khaleesi of Wall Street is back!

* According to a labor relations suit filed in 2012, Donald Trump allegedly wanted to fire female employees of Trump National Golf Club in California, who he didn't think were pretty enough. The suit was settled without any admission of wrongdoing. [Los Angeles Times] * Biglaw mega-merger alert: Word on the street is that London-based firms CMS and Olswang will join with international firm Nabarro for a three-way merger that would create a combined entity with more than 3,000 lawyers. If the merger were to go through, the firm would have more than $1.5 billion in revenue. [LegalWeek] * According to the results of this survey, corporate counsel don't think too highly of millennials when it comes to loyalty. Almost 70 percent of baby boomers and Gen Xers thought millennial lawyers in their legal departments would leave in less than five years, potentially causing "major problem[s]" in terms of turnover rates. [WSJ Law Blog] * How many women serve as lead counsel in New York state and federal courts and in mediation and arbitration? That's what a new study being conducted by the New York State Bar Association's Commercial and Federal Litigation Section hopes to find out, because "[o]nce you have a diagnosis, you can get to a solution." [New York Law Journal] * "Something is going wrong at this bank, and you are the head of it. You should be fired." Wells Fargo CEO John Stumpf may be forfeiting $41 million in pay, but lawmakers were still pretty darn upset with him when he testified before the House Financial Services Committee at a hearing yesterday. [DealBook / New York Times] * Phil C. Neal, former dean of University of Chicago Law School, RIP. [UChicago News]

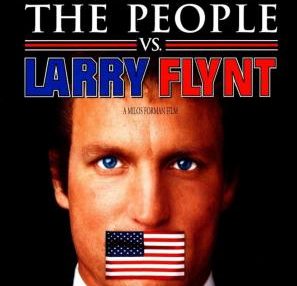

* “It would have been disastrous for the whole country.” Following Ninth Circuit Judge Alex Kozinski's screening of "The People vs. Larry Flynt," the infamous smut peddler at the center of the film received a standing ovation after speaking to an audience about what would have happened if the Supreme Court hadn't ruled in Hustler's favor in the landmark First Amendment case. [WSJ Law Blog] * Wells Fargo CEO John Stumpf will forfeit $41 million in bonus and stock awards in the wake of the lender's sham accounts scandal. As we mentioned previously, the bank's board was looking to Shearman & Sterling for guidance on whether it would move forward with clawback actions against executives considering the severity of the misconduct and fraud that occurred. [CNN] * Sorry, Lynn Tilton, but the Supreme Court isn't going to rescue you: the "Diva of Distressed" applied to the high court for a stay of the Securities and Exchange Commission's action against her, arguing that the agency's use of in-house judges was unconstitutional, but the Court flat-out rejected her request, without even so much as a dissent. Tilton could be barred from further work in the securities industry. [Bloomberg] * Chelsea Grayson, who currently serves as general counsel of American Apparel, is moving up in the company to take on an even bigger and better role. She will assume the position of chief executive officer next month as the company considers a sale. She's guided the company through controversies in the past, so a potential sale should be no problem for this former Loeb & Loeb partner. Congratulations! [Big Law Business] * A former investigator for the Illinois Appellate Defender's Office is receiving a major windfall after alleging that she was forced to resign for complaining about a salary cut. Alice Washington is set to receive more than $1 million dollars for her retaliation claim, but State Appellate Defender Michael Pelletier says he plans to appeal the judgment due to the fact that he "cannot in good conscience settle with this woman." [ABA Journal] * Michael Fahy, lawyer turned firefighter, RIP. [New York Daily News]

John Stumpf is having a sh!t sandwich for lunch again.

It’s the key to long-term success in an uncertain business climate.

* As you may have already seen, Republican presidential candidate Donald Trump released another list of his potential Supreme Court nominees ahead of tonight's debate. The list includes a Republican senator who has refused to endorse Trump (and has already turned down Trump's proposal), three non-white judges, and one female judge. [WSJ Washington Wire] * Speaking of the Supreme Court, the justices may be shorthanded and trying to avoid 4-4 deadlocks on controversial cases, but they'll soon decide whether they'll liven up this term's docket by agreeing to hear a major transgender rights case involving public school bathrooms. It could be one of the biggest case of the high court's 2016-17 term. [Reuters] * "[Twelve] students is not any kind of representation of our program." Indiana Tech Law's dean says the fact that only one of the school's graduates passed the bar isn't a realistic assessment of the quality of their education, and was unwilling to confirm the school's low pass rate since five graduates were appealing their results. [Indiana Lawyer] * The Department of Education will not suspend the American Bar Association from accrediting new law schools, despite a recommendation to do so from the National Advisory Committee on Institutional Quality and Integrity. We'd like to think that the ABA has learned its lesson, but perhaps that's a bit naive of us. [ABA Journal] * In anticipation of further fallout from its fake accounts scandal, Wells Fargo has hired Shearman & Sterling to advise the bank's board as to the legal ramifications of a possible clawback of pay from Chief Executive Officer John Stumpf, Chief Operating Officer Tim Sloan, and Carrie Tolstedt, the former head of community banking. [Bloomberg]

This man was essentially beaten to death -- verbally.